| (4) | Date Filed: |

2017

| Time and Date: | |

| Location: | |

8, 2019

| Elect the nine directors named in our proxy statement to serve until the |

| Ratify the selection of Deloitte & Touche LLP as our independent auditors for |

|

| Approve a non-binding advisory |

|

| Sincerely, | |||

| /s/ James H. Browning | /s/ | ||

| James H. Browning | Shelly Buchman | ||

| Chairman of the Board | Vice President, | ||

| and Corporate Secretary | |||

766582

i

| Time and Date: | |

| Location: | |

using the Internet at mailing your signed proxy or voting6, 2017,14, 2019, are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals on which to be voted.

“

https://materials.proxyvote.com/766582”

Page Reference for More Information |

| ||

| Election of 9 directors | 4 and | For each director nominee | |

| Management | |||

| Ratify Deloitte & Touche LLP as our independent auditors for | 41 | For | |

| Approve the RigNet, Inc. 2019 Omnibus Incentive Plan | 42 | For | |

| Stockholder advisory vote: | |||

| Approve our named executive officers’ compensation | For | ||

| Transact other business that properly comes before the meeting |

| Director | Committee Membership | Other Board Service | |||||||

| Name | Age | Since | Position with Our Company | Independent | AC | CC | CGN | CDC | Experience |

| Steven E. Pickett | 53 | 2016 | Chief Executive Officer and President | X | |||||

| James H. Browning | 67 | 2010 | Chairman, Independent Director | X | X/F | X | X* | X | |

| Mattia Caprioli | 43 | 2013 | Independent Director | X | X | X | X | ||

| Charles L. Davis | 51 | 2005 | Independent Director | X | X | X | |||

| Ditlef de Vibe | 62 | 2011 | Independent Director | X | X | X | |||

| Kevin Mulloy | 58 | 2012 | Independent Director | X | X | C | |||

| Kevin J. O’Hara | 56 | 2010 | Independent Director | X | X | C | X | ||

| Keith Olsen | 60 | 2010 | Independent Director | X | C | X | X | ||

| Brent K. Whittington | 46 | 2010 | Independent Director | X | C/F | X | |||

| 2016 Meetings | 4 | 6 | 4 | 3 | |||||

| Name | Age | Director Since | Position with Our Company | Inde-pendent | Committee Membership | Other Board Service Experience | |||||

| AC | CC | CGN | CDC | ||||||||

| Steven E. Pickett | 55 | 2016 | Chief Executive Officer and President | X | |||||||

| James H. Browning | 69 | 2010 | Chairman, Independent Director | X | X/F | X | X | ||||

| Mattia Caprioli | 45 | 2013 | Independent Director | X | X | X | X | ||||

| Ditlef de Vibe | 64 | 2011 | Independent Director | X | X | X | |||||

| Kevin Mulloy | 60 | 2012 | Independent Director | X | X | C | |||||

| Kevin J. O’Hara | 58 | 2010 | Independent Director | X | X | C | X | ||||

| Keith Olsen | 62 | 2010 | Independent Director | X | C | X | X | ||||

| Gail P. Smith | 59 | 2018 | Independent Director | X | X | X | |||||

| Brent K. Whittington | 48 | 2010 | Independent Director | X | C/F | X | |||||

| 2018 Meetings | 4 | 8 | 4 | 5 | |||||||

| AC | Audit Committee | ||

| CC | Compensation Committee | ||

| CGN | Corporate Governance and Nominating Committee | ||

| CDC | Corporate Development Committee |

ii

2016

and investor relations experience to drive execution of our strategic plan in the future.

funded to participants through the issuance of approximately 134,000 shares of our stock and, for all other employees, cash bonuses totaling approximately $1,502,000 paid in March 2019. A reconciliation of Management EBITDA to Net Income, its closest comparable GAAP metric, is presented in Appendix A to this proxy statement.

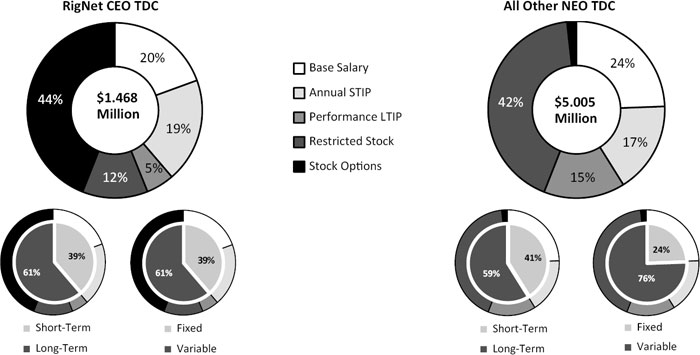

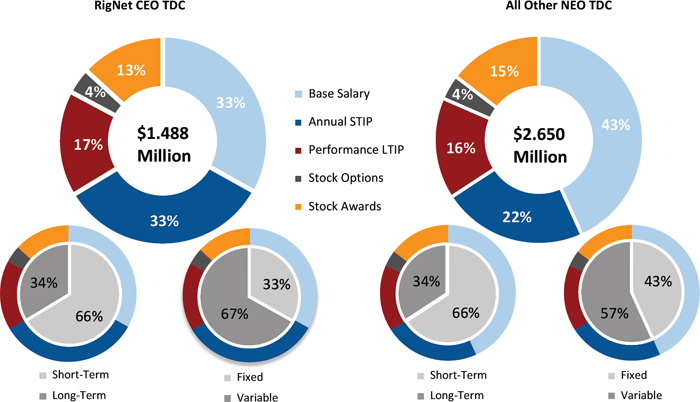

Compensation during 2016 We paid Mr. Pickett’s STIP for 2018 in shares of our interim CEO, Mr. Jimmerson and former CEO, Mr. Slaughter’s base salaries and target bonus percentages were set at $415,000 and 100%, respectively, which represents unchanged compensation levels from 2015 for the CEO and President position.common stock to further align his interests with those of our stockholders. The Compensation Committee believes that its recommendations on our CEOs’CEO’s pay reflectreflects the required leadership skills and level of responsibility givencommensurate with our current size and market conditions. The Compensation Committee also believes its decisions onthat our CEO’s pay to be consistent with prior years and represents a balanced and responsible pay-for-performance approach to compensation.

During 2016,

iii

20162018 Summary Compensation

| Salary | Bonus | Stock Awards | Option Awards | Non-Equity Incentive Plan | All Other Comp. | Total | |

| Steven Pickett (1) | $ 285,404 | $ 282,917 | $ 253,943 | $ 646,000 | $ — | $ 32,590 | $ 1,500,854 |

| Chief Executive Officer and President | |||||||

| Charles Schneider | 325,000 | — | 604,176 | — | — | 480 | 929,656 |

Senior Vice President and Chief Financial Officer | |||||||

| William Sutton | 262,000 | — | 515,760 | — | — | 480 | 778,240 |

Senior Vice President and General Counsel | |||||||

| Jay Hilbert | 42,308 | — | 165,075 | — | — | 68 | 207,451 |

| Senior Vice President, Sales | |||||||

| Edward Traupman | 37,008 | — | 88,040 | — | — | 59 | 125,107 |

| Vice President, System Integration & Automation | |||||||

| Martin Jimmerson (2) | 167,596 | — | 600,000 | — | — | 18,556 | 785,952 |

| Former Interim CEO and President and Former Chief Financial Officer | |||||||

| Mark Slaughter (2) | 33,519 | — | — | — | — | 1,813,692 | 1,847,211 |

Former Chief Executive Officer and President | |||||||

| Hector Maytorena (2) | 230,539 | — | 575,134 | — | — | 545,356 | 1,351,029 |

Former Group Vice President, Managed Services | |||||||

| Morten Hagland Hansen (2) | 123,846 | — | 399,554 | — | — | 261,297 | 784,697 |

| Former Senior Vice President and Chief Technology Officer | |||||||

| Salary | Bonus | Stock Awards | Option Awards | Non-Equity Incentive Plan | All Other Comp. | Total | ||

| Steven Pickett | $ 492,275 | $ - | $ 440,769 | $ 59,912 | $ 711,548 | $ 261,933 | $ 1,966,437 | |

| Chief Executive Officer and President | ||||||||

| Lee Ahlstrom | 127,885 | - | - | - | 170,200 | - | 298,085 | |

| Senior Vice President and Chief Financial Officer | ||||||||

| Brad Eastman | 300,000 | - | 272,643 | 37,057 | 204,723 | 11,654 | 826,077 | |

| Senior Vice President and General Counsel | ||||||||

| Jay Hilbert | 279,125 | - | 224,929 | 30,573 | 109,629 | 8,850 | 653,106 | |

| Senior Vice President, Sales | ||||||||

| Brendan Sullivan | 253,750 | - | 136,321 | 18,528 | 202,495 | 9,855 | 620,949 | |

| Chief Technology/Information Officer | ||||||||

| Tonya McDermott | 184,500 | - | 223,182 | 15,951 | 103,745 | 7,157 | 534,535 | |

| Former Interim Chief Financial Officer; Vice President, Tax and Treasury |

28.

| · | Increases to base salaries averaging 3.1% for our NEOs; |

| · | 3 year vesting periods for RSUs and stock options, reflecting practice amongst our peer companies; |

| · | New performance metrics for PUs to reflect current business environment and RigNet strategic drivers; |

| · | New individual STIP cash flow objective for each of our NEOs; |

| · | Reduced the maximum payout on PUs from 300% to 250%; and |

| · | Standardized severance packages, based on position. |

Key

✓Place a heavy emphasis on variable compensation | ✖Provide “single trigger” change in |

✓Require significant stock ownership | ✖Offer perquisites, other than relocation assistance |

✓Maintain a |

✖Allow excise tax | |

✓Conduct annual compensation risk assessments | ✖Permit hedging or short selling of Company stock |

✓Use an independent compensation consultant | ✖Re-price options and other equity incentives |

Elements

| Type | Form | Terms | |||

| Equity | Stock Options | • Options generally vest 25% per year | |||

• No automatic accelerated option vesting upon a change of control | |||||

| Restricted Stock Units | • Unit awards generally vest 25% per year | ||||

| subject to continued employment • No automatic accelerated | |||||

| Performance Units | • Unit awards generally vest based on achievement of performance measures over a multiple-year period • Awards vest at target for periods following a change in control | ||||

| Cash or Equity | • Based on achievement of

| ||||

| Cash | Salary Retirement | • Reviewed annually by the Compensation Committee • 4% match of voluntary 401(k) contributions vest immediately |

iv

Director Independence

All of our non-executive director nominees are independent. An independent director chairs each Board committee. We believe our Board should consist primarily of independent directors. See “Director Independence” on page 9 for more information.

Corporate” on page 9 for more information.

v

CONTENTS

NOTICE OF THE 2017 ANNUAL MEETING OF STOCKHOLDERS

Your vote is important. Please complete, sign, date and return your proxy or voting instruction form, or submit your vote and proxy on the Internet. Our Proxy Statement and Annual Report to Stockholders are available at “https:https://materials.proxyvote.com/766582”766582.

RIGNET, INC.

15115 Park Row Boulevard, Suite 300

Houston, Texas 77084-4947

We are furnishing this proxy statement to stockholders in connection with RigNet’s solicitation of proxies on behalf of the Board of Directors for the 20172019 Annual Meeting of Stockholders. Distribution of this proxy statement and proxy card to stockholders is scheduled to begin on or about April 3, 2017.8, 2019.

Date, Time and Place of Meeting

Our Board of Directors (“the Board”) is asking for your proxy for use at the RigNet, Inc. 20172019 Annual Meeting of Stockholders (the “Annual Meeting”) or at any adjournments or postponements thereof. The Annual Meeting will be held on Wednesday, May 3, 2017,8, 2019, at 10:8:00 a.m., Central Daylight Time Houston Marriot Energy Corridor – Reata Ballroom, 16011 Katy Freeway,at RigNet’s headquarters located at 15115 Park Row Boulevard, Suite 300, Houston, Texas 77094.77084.

Proposals

At our 20172019 Annual Meeting of Stockholders, we are asking our stockholders to consider and act upon proposals to: (1) elect nine directors to serve until our 20182020 Annual Meeting;Meeting or until their respective successors have been elected and qualified or until the earliest of their removal, resignation or death; (2) ratify the appointment of Deloitte & Touche LLP as our independent auditor for the fiscal year ending December 31, 2017;2019; (3) vote, asapprove the RigNet, Inc. 2019 Omnibus Incentive Plan; and (4) approve a non-binding advisory vote,resolution on RigNet’s executive compensation.

Who Can Attend the frequencyAnnual Meeting

Only stockholders of future advisory votesrecord as of the close of business on March 14, 2019 or the holders of their valid proxies may attend the Annual Meeting. A list of our stockholders will be available for review at our executive compensation and (4) approve,offices in Houston, Texas, during ordinary business hours for a period of 10 days prior to the meeting. Each person attending the Annual Meeting may be asked to present a photo ID, such as a non-binding advisory vote,driver’s license, before being admitted to the compensationmeeting. In addition, stockholders who hold their shares through a broker or nominee (i.e., in street name) should provide proof of our named executive officers.their beneficial ownership as of March 14, 2019, such as a brokerage statement showing their ownership of shares as of that date.

Record Date, Outstanding Shares and Quorum

Only stockholders of record at the close of business on March 6, 201714, 2019 (the “Record Date”) are entitled to notice of, and to vote at the Annual Meeting. As of the Record Date, there were 18,029,01319,471,316 shares outstanding sharesand entitled to vote at the Annual Meeting. The presence, in person or by proxy, of the holders as of the Record Date of a majority of our outstanding shares is necessary to constitute a quorum for purposes of voting on the proposals at the Annual Meeting. AbstainingAbstentions and withheld votesbroker non-votes will count as present for purposes of establishing a quorum on the proposals.

If by the date of the Annual Meeting we do not receive sufficient shares to constitute a quorum or to approve one or more of the proposals, the Chair of the Annual Meeting, or the persons named as proxies, may propose one or more adjournments of the Annual Meeting to permit further solicitation of proxies. The persons named as proxies would typically exercise their authority to vote in favor of adjournment.

Broker Non-Votes

Under New York Stock Exchange Rule 452, which governs all brokers (including those holding NASDAQ-listed securities), brokers are entitled to vote shares held by them for their customers on matters deemed “routine” under applicable rules, even though the brokers have not received voting instructions from their customers.

Brokers, however, may not vote on “non-routine” matters on behalf of their clients in the absence of specific voting instructions. A broker “non-vote” occurs when a broker’s customer does not provide the broker with voting instructions on “non-routine” matters for shares owned by the customer but held in the name of the broker. In those instances, the broker cannot vote the uninstructed shares and reports the number of such shares as “non-votes.”

Proposal 1 (election of directors), Proposal 3 (approval of RigNet, Inc. 2019 Omnibus Plan) and Proposal 4 (the non-binding advisory vote on the compensation of our named executive officers) are each considered “non-routine” matters. Accordingly, a broker may not vote on those proposals without instructions from its customer, and broker “non-votes” may occur with respect to those proposals. Proposal 2 (ratification of the appointment of the Company’s independent registered public accounting firm) qualifies as a “routine” matter. Your broker, therefore, may vote your shares in its discretion if you do not provide instructions on how to vote on this “routine” matter.

Voting

If you are a record holder of our common stock, you are entitled to one vote at the Annual Meeting for each share that you held as of the Record Date. Cumulative voting for directors is not permitted. The Inspector of Elections appointed for the Annual Meeting will tabulate all votes.

You may vote in person at the Annual Meeting or by proxy. Even if you plan to attend the Annual Meeting, we encourage you to vote your proxy card in advance of the Annual Meeting. If you plan to attend the Annual Meeting and wish to vote in person, we will give you a ballot at the meeting. However, please note that if your shares are held in “street name” (in the name of a broker or by a bank or other nominee), you are considered the beneficial owner of these shares and proxy materials are being forwarded to you by your broker or nominee, which is considered, with respect to these shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker how to vote; however, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a proxy from your brokerage firm an account statement, letter or other evidence satisfactory to us of your beneficial ownershipthe record holder of the shares. Please vote your proxy by mailor return voting instructions to your broker as soon as possible so that your shares may be represented at the Annual Meeting.

Revoking Your ProxyVoting Standards

If you submit yourWith respect to Proposal 1 (election of directors), being an uncontested election, our Bylaws require that the director nominees be elected by a majority of the votes cast at the Annual Meeting (the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that nominee). Abstentions and broker non-votes will not be counted and will have no effect on the outcome of this proposal. With respect to Proposal 2 (ratification of the appointment of the Company’s independent registered public accounting firm) and Proposal 3 (approval of the RigNet, Inc. 2019 Omnibus Incentive Plan), our Bylaws require the approval of a majority of the votes cast on these proposals. Abstentions and broker non-votes will have no effect on the outcome of this proposal. With respect to Proposal 4 (approving the compensation of our named executive officers), our Bylaws require approval by the affirmative vote of a majority of the shares present in person or represented by proxy by mail, you may still revoke it at any time before voting takes place at the Annual Meeting. If you areAbstentions and broker non-votes will have the record holdereffect of your shares and wish to revoke your proxy, you may revoke it as follows: (i) by delivering, before or at the

Annual Meeting, a new proxy with a later date; (ii) by delivering, on or before the business day prior to the Annual Meeting, a notice of revocation to our Corporate Secretary at the address set forth in the notice of the Annual Meeting; (iii) by attending the Annual Meeting and voting, although your attendance at the Annual Meeting, without actually voting, will not by itself revoke a previously granted proxy; or (iv) if you have instructed a broker to vote your shares, you must follow the directions received from your broker to change those instructions.against this proposal.

If you sign and return your proxy card but do not give any voting instructions, your shares will be voted in favor of the election of each of the director nominees listed in Proposal One, in favor of Proposal Two, “One” for Proposal Three and in favor of ProposalProposals Two, Three and Four. As far asof the date of this proxy statement we know, noare unaware of any other matters willproposal or item of business to be presented at the Annual Meeting. However, if any other matters of business are properly presented, the proxy holders named on the proxy card are authorized to vote the shares represented by proxies according to their judgment.

Revoking Your Proxy

If you submit your proxy by mail or Internet, you may still revoke it at any time before voting takes place at the Annual Meeting. A stockholder of record may revoke a proxy prior to the completion of voting at the Annual Meeting by giving written notice to our Secretary at 15115 Park Row Boulevard, Suite 300, Houston, Texas 77084, delivering a later-dated proxy in the manner provided on the proxy card (via the Internet or by written proxy card), or voting in person at the Annual Meeting. Please note, however, that only your last-dated proxy will count—any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in this proxy statement. Your attendance at the Annual Meeting, without actually voting, will not by itself revoke a previously granted proxy. If you have instructed a broker to vote your shares, you must follow the directions received from your broker to change those instructions.

Soliciting Proxies

RigNet will pay all expenses of soliciting proxies to be voted at the Annual Meeting. After the proxies are initially distributed, RigNet and its officers, directors and employees (who will not receive any additional compensation for any solicitation of proxies) may also solicit proxies by mail, electronic mail, telephone or in person. We will ask brokers, custodians, nominees and other record holders to forward copies of the proxy materials to beneficial owners for whom they hold shares.

Annual Report on Form 10-K and Additional Materials

The Notice of Annual Meeting, this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 20162018 have been made available to all stockholders entitled to vote at the Annual Meeting. These materials may also be viewed at “https:https://materials.proxyvote.com/766582”.766582.

Unless the context requires otherwise, the terms “RigNet,” the “Company,” “our,” “we,” “us” and similar terms refer to RigNet, Inc., together with its consolidated subsidiaries.

Our Board currently consists of nine directors, each of whom has a term that expires at the Annual Meeting. Each of our current Board members has been nominated to stand for re-election at the Annual Meeting. Each director elected at the Annual Meeting to our Board will serve in such capacity until his or her term expires at our next Annual Meeting or his or her successor has been duly elected and qualified, subject to the earliest of their earlier death, resignation or removal. All non-employee directors meet the independence requirements under the listing standards of the NASDAQ.NASDAQ Stock Market (“NASDAQ”). Steven Pickett our CEO who joined our Board on June 2, 2016 is not considered independent by virtue of his role as CEO and President of ourthe Company. There are no family relationships among any of our directors or executive officers.

At the Annual Meeting, our stockholders will consider and act upon a proposal to elect nine directors to our Board to serve until the 2018 Annual Meeting of Stockholders. Each of the director nominees has consented to serve as a director of the Company if so elected. The persons named as proxies in the accompanying proxy card, who have been designated by our Board, intend to voteFOR the election of the director nominees unless otherwise instructed by a stockholder in a proxy card. Each director nominee has submitted a resignation that is effective if that nominee does not receive a majority of votes cast at the Annual Meeting and if, the Board of Directors accepts the resignation. The Board of Directors must publicly disclose its decision regarding the tendered resignation within 90 days from the date of the certification of the election results. If these nominees become unable for any reason to stand for election as a director, the persons named as proxies in the accompanying proxy card will vote for the election of such other person or persons as our Board may recommend and propose to replace such nominee or nominees.

Information concerning the nine director nominees is set forth below.

| Name | Age | Position with Our Company | Director Since | |||

| Steven E. Pickett | 53 | Chief Executive Officer and President | 2016 | |||

| James H. Browning | 67 | Chairman, Independent Director | 2010 | |||

| Mattia Caprioli | 43 | Independent Director | 2013 | |||

| Charles L. Davis | 51 | Independent Director | 2005 | |||

| Ditlef de Vibe | 62 | Independent Director | 2011 | |||

| Kevin Mulloy | 58 | Independent Director | 2012 | |||

| Kevin J. O’Hara | 56 | Independent Director | 2010 | |||

| Keith Olsen | 60 | Independent Director | 2010 | |||

| Brent K. Whittington | 46 | Independent Director | 2010 |

| Name | Age | Position with Our Company | Director Since | |||

| Steven E. Pickett | 55 | Chief Executive Officer and President | 2016 | |||

| James H. Browning | 69 | Chairman, Independent Director | 2010 | |||

| Mattia Caprioli | 45 | Independent Director | 2013 | |||

| Ditlef de Vibe | 64 | Independent Director | 2011 | |||

| Kevin Mulloy | 60 | Independent Director | 2012 | |||

| Kevin J. O’Hara | 58 | Independent Director | 2010 | |||

| Keith Olsen | 62 | Independent Director | 2010 | |||

| Gail P. Smith | 59 | Independent Director | 2018 | |||

| Brent K. Whittington | 48 | Independent Director | 2010 |

Steven E. Pickett

| DIRECTOR QUALIFICATIONS | |

Industry - Current Chief Executive Officer and President of RigNet - Former CEO of 21stCentury Towers, | |

| Leadership and Global Experience – CEO and president positions for over eight years | |

Mr. Pickett has served as the CEO and President since joining ourthe Company onin May 31, 2016 and on our Boardas a director since June 2, 2016. Before joining RigNet, from March 2015 through May 2016, Mr. Pickett was the CEO and President of 21st Century Towers, a new entrant in the wireless infrastructure market. From December 2013 through February 2015, Mr. Pickett served as the CEO of WesTower Communications, Inc., North America’s second largest tower construction and maintenance company until its acquisition by MasTec.MasTec, Inc. Prior to WesTower, he was the CEO and President of Telmar Network Technology, Inc. from July 2008 until December 2013. Mr. Pickett’s other prior leadership roles include Senior Vice President/General Manager of Alcatel-Lucent’s Optical Network Division and Vice President of Sales at Alcatel. Mr. Pickett earned a Bachelor of Science in electrical engineering from Tufts University and a Master of Business Administration degree from The Kellogg Graduate School of Management at Northwestern University. He also currently serves on the board of QuEST Forum, a global association in the information and communication technologies industry. Mr. Pickett brings a wealth of experience in the communications industry to our Board and Company as well as experience running a growing company.

James H. Browning

| DIRECTOR QUALIFICATIONS | ||||

| Finance Experience–Retired KPMG LLP partner, served as KPMG’s Southwest Area Professional Practice Partner and SEC Reviewing Partner | ||||

| • | Leadership | |||

Mr. Browning has served on our Board since December 2010, and he has served as the Chairman of our Board since May 16, 2012 and Co-Chairman of our Board from March 7, 2012 to May 16, 2012. Mr. Browning previously served as a partner at KPMG LLP, an international accounting firm, from July 1980 until his retirement in September 2009. During Mr. Browning began hisBrowning’s thirty-eight year career at KPMG LLP in 1971, becoming a partner in 1980. Mr. Browning most recently servedhis leadership roles included serving as KPMG’s Southwest Area Professional Practice Partner, in Houston. Mr. Browning has also served as an SEC Reviewing Partner and as Partner in Charge of KPMG LLP’s New Orleans audit practice. Mr. Browning received a B.S. degree in Business Administration from Louisiana State University and is a retired Certified Public Accountant. He currently serves on the boards of Texas Capital Bancshares, Inc., a publicly traded financial holding company and Herc Holdings, Inc., a publicly traded full service equipment rental company. He previously served on the board of Endeavour International Corporation, a publicly traded international oil and gas exploration and production company. Mr. Browning brings a wealth of knowledge dealing with financial and accounting matters to our Board as well as extensive knowledge of the role of public company boards of directors.

Mattia Caprioli

| DIRECTOR QUALIFICATIONS | ||||

Global Experience– - Leads KKR’s Business Services industry team in Europe - Mergers, acquisitions and financing experience with Goldman Sachs in London | ||||

| | ||||

| • | Leadership | |||

Mattia Caprioli has served on our Board since October 2013. Mr. Caprioli is a member of Kohlberg Kravis Roberts & Co. L.P. (“KKR”) responsible for its Business Services industry team in Europe. Mr. Caprioli has held leadership roles in many KKR investments including Legrand, Toys ‘R’ Us, Alliance Boots, Inaer and Bond (now Avincis) since 2001. He also currently serves on the Boards of PortAventura and SBB SBB/Telemach Group and previously served on the Board of Legrand. Prior to joining KKR, Mr. Caprioli was with Goldman Sachs International in London, where he was involved in a broad array of mergers, acquisitions and financings across a variety of industries. He holds a Master of Science degree from L. Bocconi University, Milan, Italy. Mr. Caprioli brings a diverse international background with extensive business services expertise to the Board.

Charles L. DavisDitlef de Vibe

| DIRECTOR QUALIFICATIONS | |||||

Charles L. Davis has served as a member of our Board of Directors since June 2005. Mr. Davis has been a partner in Houston Ventures, formerly known as SMH Private Equity Group, a United States-based investment firm that funds companies that apply technology solutions in the energy sector, since December 2004. Mr. Davis received a Bachelor’s degree in Business from Washington and Lee University and is a Certified Public Accountant in the Commonwealth of Virginia. Mr. Davis brings experience in finance, accounting and investment banking to our Board as well as a wealth of experience in the energy industry.

Ditlef de Vibe

| Leadership and Global Experience – Former Managing Partner ofKistefos Venture Capital, a venture capital firm investing in the IT and telecommunications industries | |||

Technology - Former CEO ofGlobal IP Solutions - Various Director roles with IBM | |||

Ditlef de Vibe has served on our Board since May 2011. From 2001 to 2011, Mr. de Vibe served as managing partner of Kistefos Venture Capital, a venture capital firm that primarily invests in the IT and telecommunications industries. Since leaving Kistefos Venture Capital, Mr. de Vibe’s principal occupation is as an independent investor and board member for several private Norwegian companies. From 2007 to 2008, Mr. de Vibe also served as Chief Executive Officer of Global IP Solutions (GIPS) Holdings AB, a company that was publicly traded in Norway until its sale to Google, Inc. From 1996Prior to 2001,that, Mr. de Vibe served in various capacities with IBM, including IBM’s Director of Network Outsourcing EMEA, from 1999 to 2001, Director of Network Service Sales EMEA, from 1998 to 1999, and Director of Network Outsourcing Services EMEA from 1996 to 1998.EMEA. He holds a Master of Science degree from the University of Oslo. Mr. de Vibe brings a wealth of experience in IT and telecommunications along with extensive operational and commercial competencies.

Kevin Mulloy

| DIRECTOR QUALIFICATIONS | |||||

Leadership and Global Experience – - Partner with a consulting firm that advises on business growth and revenue issues - FormerPresident of Presidio Managed Networks

| |||||

| • | Technology Experience –Served as Executive Vice President of Corporate Development at an advanced information technology professional and managed service company | ||||

Kevin Mulloy has served on our Board since March 2012. Mr. Mulloy joined Blue Ridge Partners,a consulting firm servingadvising private equity clients and general businesses on growth and revenue issues,in February 2017 as a consulting partner. Mr. Mulloy haspreviously served as Executive Vice President of Corporate Development at Presidio, Inc., an advanced information technology professional and managed services company, from July 2011 to May 2013. Prior to that, Mr. Mulloy served as President of Presidio Managed Networks, the managed services business at Presidio, from June 2008 to July 2011, and from September 2007 to June 2008 he served as the Executive Vice President of Operational Strategy for Presidio. For the five years priorPrior to joining Presidio, Mr. Mulloy held leadership roles with Intelsat S.A., a provider of satellite services worldwide, including President of Intelsat Global Service Corporation from January 2003 to February 2006 and Senior Vice President of Strategy, Business Development and M&A from January 2001 to January 2003.&A. Mr. Mulloy’s experience also includes ten years with McKinsey & Company, a management consulting firm; three years with Gould Inc., an aerospace and defense company; and more than five years in the United States Navy, serving in the Surface Nuclear Propulsion branch of the Navy. Mr. Mulloy has a BSME from the US Naval Academy and an MBA from Wharton, University of Pennsylvania. Mr. Mulloy brings extensive operational satellite, telecommunications and information technology infrastructure experience to the Board.

Kevin J. O’Hara

| DIRECTOR QUALIFICATIONS | |||||

Industry - FormerPresident, CEO - Co-founder of Level 3 Communications, Inc., a provider of IP-based communications | |||||

| • | Leadership - - CEO and president positions for over 20 years | ||||

Kevin J. O’Hara has served on our Board since December 2010 and2010. In 2016, Mr. O’Hara served as our Vice Chairman of the Board, from January 7, 2016 through December 31, 2016.primarily to assist with our CEO transition. Mr. O’Hara most recentlyjoined Congruex, LLC, a provider of technology engineering and underground construction services, as the Executive Chairman in November 2017. Prior to that he served as President, Chief Executive Officer and Director of Integra Integra Telecom Holdings, Inc., a communications provider. He served on itsIntegra’s Board sincebeginning in December 2009, was appointed Chairman of the Board in March 2011 and was named CEO in December 2011. Mr. O’Hara left Integra in September 2014. Prior to joining Integra, he was a co-founder and Chairman of the Board of Troppus Software Corporation, an early stage software company providing technical solutions to service providers that support home technology and networks, from March 2009 until a major service provider acquired it in January 2011. Mr. O’Hara also served on the Board of Directors of Elemental Technologies, Inc., a leading provider of video processing solutions for broadcast and on-line video customers from January 2011 until October 2016, serving as Chairman from August 2011 until October 2016. Prior to that, Mr. O’Hara was a co-founder of Level 3 Communications, Inc., a provider of IP-based communications services to enterprise, content, government and wholesale customers, and served as itsin various leadership roles including President, from July 2000 to March 2008 and as the Chief Operating Officer of Level 3 Communications, Inc. from March 1998 to March 2008. From August 1997 to July 2000, Mr. O’Hara served asand Executive Vice President of Level 3 Communications, Inc.President. Prior to that, Mr. O’Hara served as President and Chief Executive Officer of MFS Global Network Services, Inc. from 1995 to 1997, and as, Senior Vice President of MFS, and President of MFS Development, Inc. from October 1992 to August 1995. From 1990 to 1992, he was a, and Vice President of MFS Telecom, Inc. Mr. O’Hara has a Master of Business Administration from the University of Chicago and a Bachelor of Science in Electrical Engineering from Drexel University. Mr. O’Hara brings a wealth of experience in the communications industry to our Board as well as experience running a public company.

Keith Olsen

| DIRECTOR QUALIFICATIONS | |||||

Industry - CEO and Director of a data center services company - Former CEO, President and Director of aprovider of network-neutral data center | |||||

| | |||||

| • | Leadership and Global Experience – - International business development with international carriers and service providers - Former Public Company CEO | ||||

Mr. Olsen has served on our Board since December 2010 when we completed our initial public offering (“IPO”).2010. Since June 2013, Mr. Olsen currently serveshas served as Chairman and Chief Executive Officer of vXchnge Holdings LLC, a private company offering data center services. Mr. Olsen previously served as Chief Executive Officer, President and Director of Switch and Data Facilities Company, Inc., a NASDAQ listed company, which provided network-neutral data centers that house, power and interconnect the Internet, from February 2004 to May 2010, when Switch and Data Facilities Company, Inc. was acquired by Equinix, Inc. Prior to that, Mr. Olsen served as a Vice President of AT&T, where he was responsible for indirect sales and global sales channel management from May 1993 to February 2004. From 1986 to 1993, Mr. Olsen servedand as Vice President of Graphnet, Inc., a provider of integrated data messaging technology and services. Mr. Olsen has a Bachelor’sBachelor degree from the State University of New York, Geneseo. Mr. Olsen brings experience in running a public company to our Board as well as a wealth of experience in the communications industry.

Brent K. WhittingtonGail P. Smith

| DIRECTOR QUALIFICATIONS | |||||

Industry and Technology Experience – - Founder and Director of a mobility and cloud research and consulting firm - Expertise in cyber security and the General Data Protection Regulation | |||||

| • | Leadership and Global Experience – - Former Corporate Group Vice President of a communications company - Managed multinational operations in telecommunications and internet services | ||||

Gail P. Smith joined our Board on January 17, 2018. Ms. Smith founded the Cavell Group, a convergence, mobility and cloud research and consulting firm, in 2002 and continues to serve as a director. Prior to that, Ms. Smith served as Corporate Group Vice President and President, Europe of Level 3 Communications, Inc. and held product marketing and strategy roles at MFS International. Ms. Smith has worked and managed operations in both the U.S. and Europe. She holds a Master degree in International Business from Tufts University and a Bachelor degree in Economics and Political Science from Claremont McKenna College. Ms. Smith brings extensive technical, operational and strategic leadership experience to the Board.

Brent K. Whittington

| DIRECTOR QUALIFICATIONS | |||

| • | Finance Experience - FormerCFO of Windstream Corporation and its predecessor, Alltel Holding - Arthur Andersen LLP experience for over eight years | ||

| | |||

| • | Leadership and Industry Experience – Former COO of acommunications company providing phone, high-speed Internet and high-definition digital TV services | ||

Mr. Whittington has served on our Board since December 2010 when we completed our IPO.2010. Mr. Whittington haspreviously served as the Chief Operating Officer of Windstream Corporation, a publicly traded communications company providing phone, high-speed Internet and high-definition digital TV services, from August 2009 to September 2014. Prior to that, Mr. Whittington served as the Executive Vice President and Chief Financial Officer of Windstream Corporation from July 2006 to August 2009. From December 2005 to July 2006, Mr. Whittington servedWhittington’s prior experience also includes serving as Executive Vice President and Chief Financial Officer of Windstream Corporation’s predecessor, Alltel Holding Corp. From 2002 to August 2005, Mr. Whittington served as, Vice

President of Finance and Accounting of Alltel Corporation, parent company of Alltel Holding Corp and from August 2005 to December 2005, Mr. Whittington also served as the Senior Vice President-Operations Support of Alltel Corporation. Prior to joining Alltel, Mr. Whittington was with Arthur Andersen LLP for over eight years. Mr. Whittington has a degree in accounting from the University of Arkansas at Little Rock. Mr. Whittington brings experience in finance and accounting to our Board as well as a wealth of experience in the communications industry.

The Board and the Company annually review RigNet’s governance documents, which are available on our website. These governance materials include, but are not limited to, our Code of Ethics and Business Conduct, Policy Governing Director Qualifications and Nominations, Policy Governing Related Person Transactions and Board committee charters. The Board regularly reviews corporate governance developments and, when appropriate, modifies its governance policies, committee charters and key practices.

Code of Ethics and Business Conduct

We have a Code of Ethics and Business Conduct applicable to our principal executive, financial and accounting officers and all persons performing similar functions. A copy of that code is available on our corporate website at the following link

“http://investor.rig.net/corporate-governance.cfm”.code-ethics-and-business-conduct-2.

Composition of the Board of Directors

Our Board currently consists of nine members, eight of whom are non-employee members. Mr. Pickett, who serves as theour CEO and President, also serves as a director.director of the Company. Each director holds office until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. Our by-lawsBylaws permit our Board to establish by resolution the authorized number of directors.

With respect to the Annual Meeting, we have nine nominees and nine available board seats. Currently,As this election will involve an uncontested election of directors, in order to be elected to the board at the Annual Meeting, each nominee must receive a boardmajority of the votes cast. Any current director who does not receive a majority of “For” votes at the Annual Meeting must tender his or her resignation to the Board in accordance with the Board’s majority vote resignation policy, which is described in our bylaws. A Board member may be removed outside of the normal election process by the affirmative vote of the holders of a majority of the shares then entitled to vote at an election of our directors. The nine nominees receiving the most votes cast at the Annual Meeting will be elected to our Board.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

Currently, we separate the role of Chairman and Chief Executive Officer. In addition, each Board committee is presently comprised solely of independent directors. The Chief Executive Officer is responsible for setting the strategic direction for the Company, with the advice of the Board, and the day-to-day leadership and performance of the Company, while theCompany. The Chairman of the Board operates as lead independent director and provides guidance to the Chief Executive Officer, approves the agenda for Board meetings, and presides over meetings of the full Board. The independent members of the Board also regularly meet in executive session without management present. The Board believes this separation allows our CEO to focus on running the company and our chairman to focus on running the Board, which is appropriate at this time because of the brief tenure of most of our public status.senior management. Our Board does not have a policy on whether or not the roles of Chairman of the Board and Chief Executive Officer should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee or former employee. The Board believes that it should be free to make a choice from time to time in any manner that it believes is in the best interests of our Company and our stockholders at that time.

From January 7, 2016 through December 31, 2016, we also had an independent director serving as the Vice Chairman of the Board to lead our efforts in the search and selection of a new, permanent Chief Executive Officer and President and actively collaborate with the former interim CEO and executive team to support our next phase of development both in merger and acquisition activities and other initiatives to expand our products and solutions. The Board actively oversees management, particularly through regular conferences between the Chief Executive Officer and the Chairman. The Board reviews the Chairman of the Board position annually after the Annual Meeting of Stockholders.

Risk Oversight

Risk is an inherent part of RigNet’s business activities and successful management of that risk is critical to the Company’s growth and success. The Board seeks to assess major risks facing ourthe Company and options for their mitigation in order to promote our stockholders’ and other stakeholders’ long-term interests. We reward our executives for taking responsible risks in line with the Company’s strategic objectives and overall risk appetite. Depending on the nature of the risk involved and the particular business function involved, we use a wide variety of risk mitigation strategies, including delegation of authorities, standardized processes, strategic planning, operating reviews and insurance.

The Board has oversight for risk management and actively reviews risk management practices through continuous dialogues and receipt of management reports. The Board and its committees collectively oversee risk by actively reviewing material management decisions throughout the year in the areas that risk responsibility has been delegated.

The Board has delegated responsibility for the oversight of specific risks to the Board committees as follows:

| Corporate Governance and Nominating | Confirms the existence and capability of risk management systems and controls specific to operational, technological, compliance, reputational and political risks | |

| Reviews assessments and implementation of risk-based controls for our | ||

| Oversees risk related to the Company’s governance structure and processes | ||

| • | Monitors cybersecurity programs | |

| Audit | Oversees policies and processes related to the financial statements, financial reporting process, compliance and auditing | |

| Monitors ongoing compliance issues and matters and meets with our independent accounting firm | ||

| Reviews risk management practices and performance related to credit, liquidity and compliance risks | ||

| Compensation | ||

| Oversees | ||

| Evaluates | ||

| Corporate Development | ||

| Provides guidance related to corporate development opportunities | ||

| Reviews risk mitigation strategies in connection with merger and acquisition initiatives | ||

The extent of the Board’s oversight function has the effect of solidifying the Board’s leadership structure by providing knowledge and input into material risk decisions.

Our Board has reviewed the independence of each director nominee and considered whether any directornominee had or has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board has determined that Ms. Smith and Messrs. Browning, Caprioli, Davis, de Vibe, Mulloy, O’Hara, Olsen, and Whittington qualify as “independent” in accordance with the published listing standards of the NASDAQ. Mr. Pickett is not considered independent by virtue of his role as CEO and President of ourthe Company.

In addition, the members of the Audit Committee of our Board each qualify as “independent” under standards established by the SEC and NASDAQ for members of audit committees, and the Audit Committee includes at least one member who is determined by our Board to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules. Messrs. Browning and Whittington are independent directors who have been determined to be audit committee financial experts. Stockholders should understand that this designation is a disclosure requirement of the SEC related to Messrs. Browning and Whittington’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose on them any duties, obligations or liability that are greater than arethose generally imposed on them as members of the Audit Committee and Board, and their designation as audit committee financial experts pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or Board.

In addition, the members of the Compensation Committee of our Board each qualify as “independent” under standards established by the SEC and NASDAQ for members of compensation committees.

POLICY GOVERNING DIRECTOR QUALIFICATIONS AND NOMINATIONS

OurThe Company seeks directors who possess, at a minimum, the qualifications and skills described below and as set forth in our Policy Governing Director Qualifications and Nominations. Nominations found on our website at http://investor.rig.net/policy-governing-director-qualifications-and-nomination.

Our Company considers diversity in its nomination of directors, and in its assessment of the effectiveness of the Board and its committees. In considering diversity, we evaluate each director candidate in the context of the overall composition and needs of our Board, with the objective of recommending a group that can best manage the business and affairs of the Company and represent stockholder interests using itstheir combined diversity of experience. Our Corporate Governance and Nominating Committee will consider these and other qualifications, skills and attributes when recommending candidates to our Board.

At a minimum, our Corporate Governance and Nominating Committee must be satisfied that each Committee-recommended nomineeperson that it nominates meets the following minimum qualifications:

In addition to the minimum qualifications for each candidate set forth above, our Corporate Governance and Nominating Committee shall recommendrecommends that our Board select persons for nomination to help ensure that:

In addition, forFor the overall structure and composition of our Board, the Corporate Governance and Nominating Committee seeks directors with the following types of experienceexperience:

Leadership experience.We believe that directors who have held significant leadership positions, especially CEO positions, over an extended period, provide the Company with unique insights. These peopleindividuals generally possess extraordinary leadership qualities and the ability to identify and develop those qualities in others. They demonstrate a practical understanding of organizations, processes, strategy and risk management, and know how to drive change and growth.

Global experience.RigNet’s continued success depends, in part, on its success in continuing to grow its businesses outside the United States. For example, in 2018, approximately 70.0% of RigNet’s revenues came from outside the United States.

Technology experience.As a technology-based communication company, we seek directors with backgrounds in technology and a deep understanding of technology risks because our success depends on the reliability of our technology, investments in new technologies and access to new ideas.

Global experience.RigNet’s continued success depends, in part, on its success in continuing to grow its businesses outside the United States. For example, in 2016, approximately 70% of RigNet’s revenues came from outside the United States.

Finance experience.We believe that an understanding of finance and financial reporting processes is important for our directors as RigNet measures its operating and strategic performance by reference to financial goals. In addition, accurate financial reporting and robust auditing are critical to RigNet’s success. We seek to have directors who qualify as audit committee financial experts, and we expect all of our directors to be financially knowledgeable. As part of this qualification, we also seek directors who have relevant risk management experience.

Industry experience.We seek to have directors with experience as executives, or directors or in other leadership positions in the industries in which we participate. For example, we seek directors with experience in the communications and oil and gas industries, since many of our customers operate in the oil and gas industry.technology industries.

Marketing experience.Board Tenure.RigNet seeks to grow organically by identifyinghave directors with a variety of tenure on the Board, providing an influx of new ideas while ensuring stable and developing new markets for its products as well as by acquisition. Therefore, marketing expertise, especially oncontinuous oversight. Our director tenure currently ranges from 1 to 9 years with an international basis, is important to us.average of 6.8 years.

COMMUNICATIONS TO OUR BOARD OF DIRECTORS

Our Board has a process in place for communications with stockholders. Stockholders should initiate any communications with our Board in writing and send them to our Board, c/o William Sutton, SeniorShelly Buchman, Vice President, andRigNet Connect, Associate General Counsel and Corporate Secretary, RigNet, Inc., 15115 Park Row Boulevard, Suite 300, Houston, Texas 77084-4947. All such communications will be forwarded to the appropriate directors. This centralized process will assist our Board in reviewing and responding to stockholder communications in an appropriate manner. If a stockholder wishes for a particular director or directors to receive any such

communications, the stockholder must specify the name or names of any specific Board recipient or recipients in the communications. Communications to our Board must include the number of shares owned by the stockholder as well as the stockholder’s name, address, telephone number and e-mail address, if any.

MEETINGS OF OUR BOARD OF DIRECTORS AND ATTENDANCE AT ANNUAL MEETINGS

During 2016,2018, our Board held teneight meetings. The standing Committees of our Board held an aggregate of 1721 meetings during this period. Each director attended at least 75% of the aggregate number of meetings of the Board and Committees on which they served. Each member of our Board is expected to attend our annual meetings of stockholders. Each person who was a director at the time of our 20162018 Annual Meeting of Stockholders attended such meeting.meeting, except for Mr. Davis, who did not stand for reelection.

COMMITTEES OF OUR BOARD OF DIRECTORS

Our Board currently has standing Audit, Compensation, Corporate Governance and Nominating and Corporate Development Committees. Each member of the Audit, Compensation, Corporate Governance and Nominating and Corporate Development Committees is an independent director in accordance with the NASDAQ listing standards described above and applicable SEC regulations. Our Board has adopted a written charter for each of these Committees,committees, each of which sets forth each Committee’sthe applicable committee’s purposes, responsibilities and authority. These committee charters are available on our website at “http:http://investor.rig.net/corporate-governance.cfm”.corporate-governance/committees through links to each respective committee.

Audit Committee

| Audit Committee | ||||

| Select and oversee the independent accounting firm | Number of Meetings in | |||

| Oversee the quality and integrity of our financial reporting | 4 | |||

| Review the organization and scope of our internal audit function and our disclosure and internal controls | Committee Members: | |||

Whittington (C, F, I)

| ||||

| Approve audit and non-audit services provided by our independent auditors | ||||

| Oversee investigations of any allegations of policy or compliance violations | ||||

| Ÿ | Monitor financial reporting activities and the accounting standards and principles followed | |||

| C | Chair of the Committee |

| F | Audit Committee Financial Expert as defined under SEC rules |

| I | Satisfies standards established by the SEC and NASDAQ to be designated as an independent director |

The report of our Audit Committee appears under the heading “Report of the Audit Committee” below.

Compensation Committee

| Compensation Committee | |||

| Review and recommend for Board approval the compensation of the CEO | Number of Meetings in | ||

| Review and recommend for Board approval the compensation of the Board | |||

| Make recommendations to the Board with respect to our executive officers, other than the CEO | Committee Members: | ||

| Administer and implement Board approved compensation plans, policies, and programs, including short and long-term incentive plans | Olsen (C, I) de Vibe (I) O’Hara | ||

| Review succession planning for our executive officers | |||

All Compensation Committee members are also “non-employee directors” as defined by Rule 16b-3 under the Securities Exchange Act of 1934, as amended (“Exchange Act”). The report of our Compensation Committee appears under the heading “Compensation Committee Report” below.

Procedures and Processes for Determining Compensation –- Please refer to “Compensation Discussion and Analysis, The Compensation Committee,” below for a discussion of the Compensation Committee’s procedures and processes for making compensation determinations.

Compensation Committee Interlocks and Insider Participation –- No member of the Compensation Committee has any relationship with our Company requiring disclosure in any of the reports that we file with the SEC, other than service on our Board. None of our named executive officers serves as a member of the Board or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board or Compensation Committee.

Corporate Governance and Nominating Committee

| Corporate Governance and Nominating Committee | |||

| Identify and recommend nominees for the Board | Number of Meetings in | ||

| Monitor and develop our corporate governance practices, guidelines, code of ethics and business conduct and compliance mechanisms | 4 Committee Members: O’Hara (C, I) Smith (I) | ||

| Review risk performance and enterprise risk exposure across operational, technological, compliance, reputational and political areas | |||

| |||

Monitor the existence and capability of risk management systems and control in all critical business activities and enterprise risk categories | |||

The Committee will evaluateevaluates each director nominee based upon a consideration of athe nominee’s qualification as independent as well as their diversity, skills and experience in the context of the needs of the Board as described in our Corporate Governance Guidelines. The Corporate Governance and Nominating Committee may rely on various sources to identify director nominees. These include input from directors, management, professional search firms and other sources that the Committee feels are reliable.

Stockholders may recommend director candidates for consideration by the Corporate Governance and Nominating Committee, which will consider such suggestions made by stockholders in the same manner as other candidates. Any such suggestions should be submitted to the Chairman of the Corporate Governance and Nominating Committee, c/o William Sutton, SeniorShelly Buchman, Vice President, andRigNet Connect, Associate General Counsel and Corporate Secretary, RigNet, Inc. 15115 Park Row Boulevard, Suite 300, Houston, Texas 77084-4947. The written request must include the candidate’s name, contact information, biographical information and qualifications. The request must also include the potential candidate’s written consent to being named as a nominee and to serving as a director if nominated and elected. The Committee may request additional information from time to time from the nominee or the stockholder or group of stockholders.nominating stockholder(s). Stockholder nominations that seek to bypass the consideration of the Corporate Governance and Nominating Committee must follow the procedures set forth in our bylaws, which are summarized below inunder the Section entitledheading “Stockholder Proposals and Nominations for the 20182020 Annual Meeting.”

Corporate Development Committee

| Ÿ | Provide oversight and guidance for the evaluation of corporate development opportunities | Number of Meetings in | ||

| 5 | ||||

Ÿ | Provide oversight and guidance over the strategies and processes regarding merger and acquisition initiatives | Committee Members: | ||

Mulloy (C, I) Caprioli (I)

| ||||

In addition to these standing committees, in 2019 our Board established a Special Litigation Committee to oversee matters related to ongoing litigation described in our Annual Report on Form 10-K. Mr. Whittington is the chair of the Special Litigation Committee, which also includes Messrs. Mulloy and O’Hara.

The Audit Committee oversees the financial reporting process of the Company on behalf of itsthe Board. Management has the primary responsibility for the preparation of the financial statements and the reporting process, including the systems of internal control.

With respect to the financial statements for the year ended December 31, 2016,2018, the Audit Committee reviewed and discussed the financial statements of RigNet, Inc. and the quality of financial reporting with management, the internal auditor and the independent auditor. The Audit Committee has discussed with the independent auditor the matters required to be discussed by Auditing Standard No. 1301 (Communications with Audit Committees). The Audit Committee received the written disclosure and the letter from the independent auditor required under applicable rules of the Public Company Accounting Oversight Board. Additionally, the Audit Committee has discussed with the independent auditor their independence with respect to the Company. The Audit Committee determined that the non-audit services provided to RigNet by the independent auditor (discussed below under “Proposal Two: Ratification of Independent Public Accountants”) are compatible with maintaining the independence of the independent auditor.

Based on the reviews and discussions described above, the Audit Committee recommended to our Board that the financial statements of RigNet, Inc. be included in the Annual Report on Form 10-K for the year ended December 31, 20162018 for filing with the SEC.

| Submitted By: | ||

| Audit Committee | ||

Brent K. Whittington, Chairman James H. Browning

Kevin Mulloy Gail P. Smith |

This Report of the Audit Committee is not “soliciting material” and shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except to the extent the Company specifically incorporates this report by reference, and shall not otherwise be deemed filed under such Acts.

The following summarizes the compensation of each non-employee member of our Board for the fiscal year ended December 31, 2016. Since June 2, 2016, our CEO2018. Because Mr. Pickett is also a board member. Our former CEO served as a board member until his resignation on January 31, 2016. Since our CEOs were employeesan employee of the Company, they didhe does not receive additional compensation specifically related to his service on our Board.Board of Directors. In addition, Mr. Caprioli does not receive any compensation from us for his role as a member of our Board due to his affiliation with KKR, a holder of over 25% of our outstanding shares of common stock.

Our Board has implemented a compensation policy applicable to our non-employee directors based on the anticipated service commitment and analysis of our peer companies based onusing data obtained from our compensation consultant, which provides thoseconsultant. We provide our non-employee directors the following compensation for Board and committee services:

| ● | a cash retainer paid quarterly for | |

| ● | an additional cash retainer for our non-executive board chairman; | |

| ● | an annual | |

| the Company; |

| ● | a cash fee for each Board meeting where overseas travel is required for attendance; and | |

| ● |

Director compensation is paid at the end of each quarter on a pro rata basis for any partial service periods. Director compensation during 2018 included quarterly cash retainers for: independent directors at $12,500; board chairman additional retainer at $14,750; meeting fees requiring overseas travel at $3,000; non-chairman committee members ranging from $1,000 to $1,500 based on the service commitment required by each committee; the Audit Committee chairman at $5,750, the Compensation Committee chairman at $4,000, the Corporate Governance and Nominating Committee chairman at $3,750 and the Corporate Development Committee chairman at $2,500.

TheAnnually, the Board determines the form and amount of director compensation after its review of recommendations made by the Compensation Committee. In January 2016, the Board elected Mr. O’Hara to serve as Vice Chairman of our Board to lead the search and selection of a new, permanent Chief Executive Officer and President. He was also tasked with taking an active role in the Board’s oversight of management’s 2016 and mid-term business plan during the transition. This role included leading Board oversight of the former interim CEO and executive team’s implementation of strategy for the next phase of development both in merger and acquisition activities and other initiatives to expand our products and solutions. Due to the significant service demand, the Board approved an increase in Mr. O’Hara’s quarterly cash board retainer to $62,500 for his service as Vice Chairman of the Board, until September 30, 2016 upon the successful CEO leadership transition to Mr. Pickett.

In June 2016, the Board approved non-executive director compensation changes effective July 1, 2016 including: the elimination of board and committee meeting fees not requiring overseas travel; an increase to the quarterly cash retainer for independent directors from $9,000 to $12,500; the reduction in meeting fees requiring overseas travel from $4,500 to $3,000; the establishment of committee member quarterly cash retainers ranging from $1,000 to $1,500 per quarter based on the service commitment required by each committee; an increase in the quarterly cash retainers for the Audit Committee chairman from $3,750 to $5,750, the Compensation Committee chairman from $2,500 to $4,000 and the Corporate Governance and Nomination Committee chairman from $2,500 to $3,750. The Corporate Development Committee chairman quarterly cash retainer remained unchanged at $2,500. The Compensation Committee recommended the changes in board compensation after reviewingreviews peer company market data supplied by the Compensation Committee’sits independent consultant, data obtained through the National Association of Corporate Directors and by considering the relative service demands of each service role.role on an annual basis and, in 2018, recommended no changes in board compensation.

The following table summarizes the compensation of each non-employee member of our Board in 2016:2018:

| Name (1) | Earned or Paid in Cash (2) | Stock Awards (3) | Total | ||||||

| James H. Browning | $ 133,000 | $ 100,000 | $ 233,000 | ||||||

| Mattia Caprioli (4) | — | — | — | ||||||

| Charles L. Davis | 60,000 | 100,000 | 160,000 | ||||||

| Ditlef de Vibe | 72,500 | 100,000 | 172,500 | ||||||

| Kevin Mulloy | 68,000 | 100,000 | 168,000 | ||||||

| Kevin J. O’Hara | 209,000 | 249,995 | 458,995 | ||||||

| Keith Olsen | 73,500 | 100,000 | 173,500 | ||||||

| Brent K. Whittington | 76,000 | 100,000 | 176,000 | ||||||

| Name (1) | Earned or Paid in Cash (2) | Stock Awards (3) | Total | ||

| James H. Browning | $ 122,680 | $ 99,074 | $ 221,754 | ||

| Mattia Caprioli (4) | - | - | - | ||

| Charles L. Davis (5) | 20,167 | - | 20,167 | ||

| Ditlef de Vibe | 60,000 | 99,074 | 159,074 | ||

| Kevin Mulloy | 66,000 | 99,074 | 165,074 | ||

| Kevin J. O’Hara | 71,000 | 99,074 | 170,074 | ||

| Keith Olsen | 71,000 | 99,074 | 170,074 | ||

| Gail P. Smith (6) | 65,500 | 133,084 | 198,584 | ||

| Brent K. Whittington | 77,000 | 99,074 | 176,074 | ||

| (1) | ||

| (2) | Amounts reflect quarterly retainers and fees for Board and committee service earned by the directors during | |

| 2018. |

| (3) | Reflects the aggregate grant date fair value for restricted units granted to each independent director in | |

| Mr. Caprioli and Mr. Davis had no outstanding awards. |

| (4) | Mr. Caprioli received no compensation from RigNet for his Board service |

| (5) | Mr. Davis did not stand for reelection at our 2018 annual board meeting, resulting in his term ending on May 2, 2018. Subsequent to serving on our Board, Mr. Davis provided the Company’s management consulting services during 2018 for fees totaling approximately $74,600. |

| (6) | Ms. Smith joined our Board in January 2018 and was awarded a restricted unit award upon joining the Board of 1,790 units, which vested on January 17, 2019. Ms. Smith also received the same annual restricted unit award awarded all Board members on May 4, 2018 of an additional 6,627 units, which vest on May 4, 2019. |

The table above reflects all compensation received by our independent directors during 2016.2018. The Company does not provide a pension plan for non-employee directors.

EEXECUTIVEXECUTIVE COMPENSATION

The following table provides information regarding our current executive officers.

| Name | Age | Position with Our Company | ||

| Steven Pickett | Chief Executive Officer and President | |||

| Senior Vice President and Chief Financial Officer | ||||

| Senior Vice President and General Counsel | ||||

| Jay Hilbert | Senior Vice President, Sales | |||

| James Barnett, Jr. | 65 | Senior Vice President of Government Services | ||

| Brendan Sullivan | 45 | Chief Technology/Information Officer | ||

| Edward Traupman | Vice President | |||

Steven Picketthas served as our Chief Executive Officer and President since May 31, 2016. See his biographical summary presented earlier in this proxy statement under the heading “Our Board of Directors and Nominees“Governance – Director Nominees.”

Charles SchneiderMr. Lee Ahlstrom has served as our Chief Financial Officer since August 20, 2018. Prior to joining the Company, Mr. Ahlstrom served as the Senior Vice President and Chief Financial Officer since December 8, 2015. Priorof Paragon Offshore, Ltd, a spin-off from Noble Corporation, from November 2016 to that, Mr. Schneider served in various financial leadership roles at KBR, Inc. includingMarch 2018, and as Senior Vice President of Investor Relations and Chief Financial Officer for the Engineering and Construction, Americas divisionPlanning from January 2015August 2014 to December 2015;October 2016. Mr. Ahlstrom served as Noble Drilling’s Senior Vice President Financeof Strategic Development from May 2011 to July 2014 and Treasurer from February 2010 to December 2014;as the Vice President Corporate DevelopmentInvestor Relations and Planning from December 2008May 2006 to February 2010; and interim Chief Financial Officer from March 2008 to June 2008. In addition, his professional career includes experience in commercial banking, project finance, corporate finance and M&A.July 2014. Mr. SchneiderAhlstrom received a B.B.A.Master and Bachelor degree in finance and a MBA from the University of Texas at Austin, McCombs SchoolDelaware. Mr. Ahlstrom serves on the Board of Business.the National Investors Relations Institute (NIRI) and holds the NIRI investor relations charter credential.

William SuttonBrad Eastman has served as our Senior Vice President and General Counsel since February 2014.October 30, 2017. Prior to that, Mr. SuttonEastman served as ourGeneral Counsel of the Cameron Group of Schlumberger Limited following Schlumberger’s acquisition of Cameron International in April 2016 until October 2017. Prior to the acquisition, Mr. Eastman served in various positions in the Cameron legal department, most recently as Vice President and Deputy General Counsel of Cameron International from June 2011 until April 2016. Mr. Eastman also held leadership positions of Vice President, General Counsel and Corporate Secretary of Input/Output, Inc. from May 2009 through January 20142001 until 2004 and Vice President, Secretary and General Counsel of Quanta Services from March 2008 through May 2009.1998 until 2001. Mr. Sutton served as Chairman for Sweeten & Sutton Brokerage, Inc. from March 2007 to February 2008 and President and Chief Executive Officer for Abbey SA, LP from April 2004 to October 2006. He has attended Stanford Law School’s Directors’ College. Mr. SuttonEastman received a Bachelor of Business Administration degree from the University of Texas at Austin and a Juris Doctorate from the University of Houston. Harvard University.

Jay Hilberthas served as our Senior Vice President, Sales since joining RigNet on November 7, 2016. Prior to that, Mr. Hilbert served as Senior Vice President of Business Development and Sales - Airvana Business Unit for CommScope Holding Company, Inc., a global provider of wireless solutions from January 2015 until November 2016; Senior Vice President of Global Sales for Cambium Networks from January 2012 through December 2014; and Senior Vice President of Sales and Marketing for Telmar Network Technology from 2007 through 2011. Mr. Hilbert also served in sales leadership positions for Spirent Communications and Somera Communications. Mr. Hilbert received a Bachelor of Science degree in Engineering Management from the University of North Dakota.

James Barnett, Jr. has served as our Senior Vice President, Government Services since joining RigNet on January 7, 2019. Prior to joining the Company, Mr. Barnett served as the Chairman of the telecommunications group and Partner in the cybersecurity practice of Venable LLP from February 2013 to January 2019. Prior to that, Mr. Barnett was the Senior Vice President for National Security Policy at the Potomac Institute for Policy Studies from May 2012 until February 2013. From July 2009 until April 2012, Mr. Barnett served as Chief of the Public Safety and Homeland Security Bureau of the Federal Communications Commission (the “FCC”). Prior to joining the FCC, Mr. Barnett served as a research fellow at the Potomac Institute for Policy Studies from June 2006 until June 2009. Mr. Barnett also served as a surface warfare officer in the United States Navy, most recently as Deputy Commander of the Naval Expeditionary Combat Command and retired as a Rear Admiral. Mr. Barnett holds a Bachelor degree and a Juris Doctorate from the University of Mississippi.

Brendan Sullivan has served as our Chief Technology/Information Officer since May 30, 2017. Prior to that, Mr. Sullivan served as the Executive Vice President of Global Technology and Operations for Vubiquity from September 2013 until October 2016, the Senior Vice President of IT, Engineering and Network for Digital Generation, Inc. from May 2009 until September 2013, and the Senior Director of Content Markets Application Development for Level 3 Communications from 2000 until 2009. Mr. Sullivan also worked at Andersen Consulting. He received a Bachelor degree from Brown University.

Edward Traupmanhas served as our Vice President, Products and Services since April 2018 and our Vice President, Systems Integration & Automation since joining RigNet onin November 7, 2016.2016 to April 2018. Prior to that, he served as the Vice President and General Manager for Telmar Network Technology from January 2007 through February 2016. Mr. Traupman has also served in various management positions with companies such as Carrius Technologies, Rapid5 Networks and DSC Communications. He received a Master of Science degree in Computer Science and a Bachelor degree in Mathematics from the Southern Methodist University.

COMCOMPENSATIONPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion & Analysis (“CD&A”) outlines RigNet’s executive compensation philosophy, objectives and processes and explains how the Compensation Committee of the Board (the “Compensation Committee” or “Committee”) made executive compensation recommendations to the Board in fiscal year 20162018 for the named executive officers (“NEOs”) listed below:

| Name | Position with Our Company |

| Steven Pickett | Chief Executive Officer and President |

| Senior Vice President and Chief Financial Officer | |

| Senior Vice President and General Counsel | |

| Jay Hilbert | Senior Vice President, Sales |

| Former Interim Chief | |

| (1) | Mr. Ahlstrom joined RigNet on August 20, 2018. |

| (2) | Ms. McDermott served as our interim Chief Financial Officer | |

EXECUTIVE SUMMARY

20162018 Business Overview and Compensation Outcomes

The Board of Directors believe recentWith our new executive leadership changes will position theteam in place, RigNet successfully executed on its strategic plan in 2018. The Company fordemonstrated continued growth in the oilof market share and gas sectorexpansion through acquisitions and accelerateintroduction of new products to further diversify our strategic expansionbusiness into adjacent remote communications markets.communication markets and verticals. The CEO and other NEOs responded to 2016’s continued challenging2018’s economic market conditions with reduced oil and gas industry activity by reallocating resources and restructuring personnel while maintaining positive cash flow from operating activities. The CEO and other NEOs also developed and executed a plan to reduce operating costs for long-term financial stability.fund estimated litigation contingencies arising from litigation described in our Annual Report on Form 10-K.

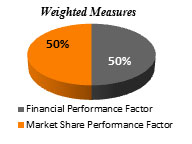

On anWhen making annual basis,compensation decisions, our Compensation Committee takes into consideration the impact ofour business environment, the results of our operations and the competitive market for talent when making its decisions about compensation.talent. It also must taketakes into account the way in which the plans in our executive compensation program areis designed. It is in this context that the Compensation Committee made the following key compensation decisions for 2016:2018:

| ● |

| ● |

| ● |

Specifically,In summary, 2018 base salaries, STIP bonus resultstargets and long-term incentivepayouts LTIP targets are summarizedand grant date fair values were as follows:

| Base Salary | STIP Bonus | Long-term Incentive Plan | Retention | |||||||||||||||||||||||||

| Name | 2016 | 2015 | Target | Amount | Target | Grant Date | Equity | |||||||||||||||||||||

| Value | Awards | |||||||||||||||||||||||||||

| Steve Pickett (1) | $ | 485,000 | n/a | 100.0% | $ | — | 100.0% | $ | 899,943 | $ | — | |||||||||||||||||

| Charles Schneider | 325,000 | $ | 325,000 | 70.0% | — | 140.0% | 456,816 | 147,360 | ||||||||||||||||||||

| William Sutton | 262,000 | 262,000 | 65.0% | — | 140.0% | 368,400 | 147,360 | |||||||||||||||||||||